Malaysian Citizen or Permanent Resident company name ends with the word Sdn Bhd. You must provide three names in case of one name not being available.

Differences Between Sole Proprietorship And Llc Ebizfiling

A sole proprietorship is basically the simplest form of business ownership there is and in Malaysia it is governed by the Registration of Businesses Act 1956.

. Apart from this the following requirements must be met in. The sole trader receives all profits subject to taxation. Thereby no separate tax return file is needed.

Foreigners and corporate legal entities are not permitted to register sole proprietorships in Malaysia. Malaysia airlines isfocuses on the tertiary citiesmalaysia. The differences between a sole proprietorship and a private limited company are summarised below -.

Types of businesses in malaysia sole proprietorship partnership limited liability partnership llp private limited company sdn. A sole proprietorship is a type of business that is own and run by an individual alone. However the sole proprietor or partner will be personally liable for their business income and losses and their tax filings are computed into their individual income tax.

Sole proprietorship in Malaysia Owners of sole proprietorships have unlimited liability and they are the only ones responsible for the businesss capital and profits. Only the business owner can apply for a sole proprietorship. A sole proprietorship is the most common and simplest legal business structure in Malaysia.

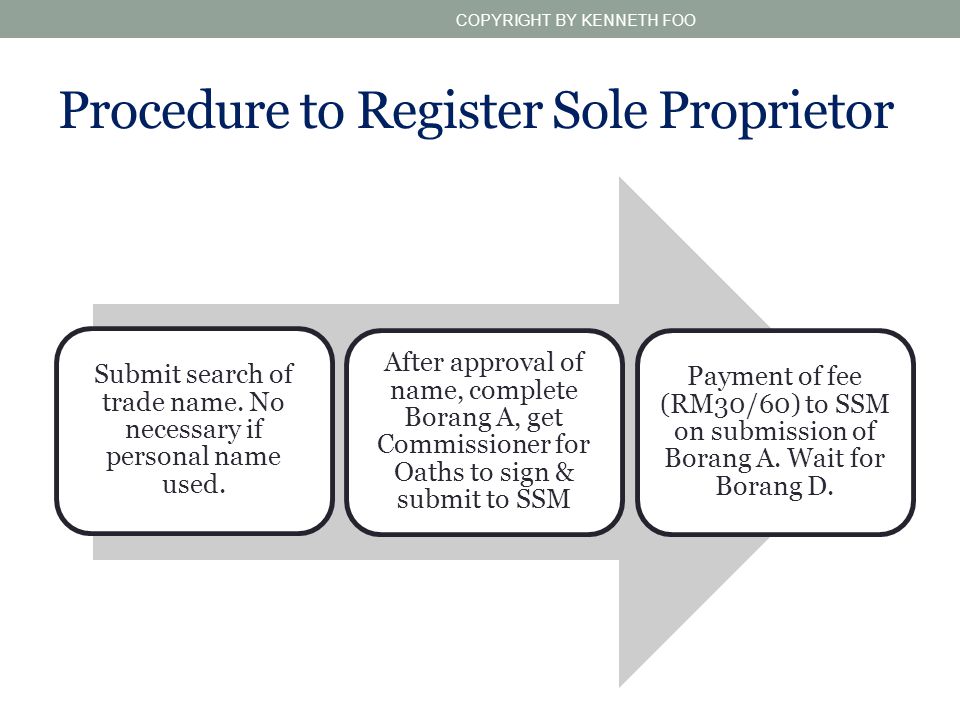

A sole proprietorship is a wholly owned business by a single individual using his personal name or a trade name. Visit any Companies Commission of Malaysia SSM branch to complete the registration form The SSM officer will assist to check the availability of the proposed name. However he can be sued in his name or his business name 9.

Business wholly owned by a single individual using personal name as per his her identity card or trade name. To start the registration process in Malaysia for either a sole proprietorship or partnership you will need to prepare and provide the following documentation. All profits and losses go directly to the business owner.

Sole proprietorships in Malaysia are charged the income tax on a gradual scale applied to the individual income from 2 to 26. Two 2 types of businesses. There are four steps to form the sole proprietorship in Malaysia.

Registration may be completed in within an hour allowing you to begin operating your business immediately. 3 Jalan 910 Seksyen 9 Karung Berkunci 221 43659 Bandar Baru Bangi Selangor. Menara Hasil No.

Unlike a corporation a sole proprietorship is not a separate entity from the person who owns it. Sole proprietorships and partnerships are the easiest forms of business to be registered hence the most popular forms of business. Prepare the required registration fee of RM60-RM100 cash.

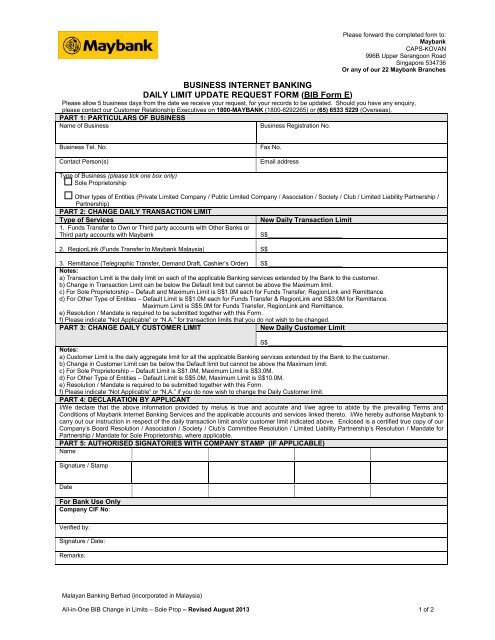

SOLE PROPRIETORSHIP Trade Name Registration Fee RM 6000 a year The business is owned by 1 individual PARTNERSHIP Trade Name Registration Fee RM 6000 a year Business is owned by two 2 or more persons but not exceeding 20 persons Additional RM500 a year for each branch registered and RM1000 excluding SST for business information print-out. To do this you will need to register your new business at a local SSM branch. To register Sdn Bhd click here.

A sole proprietorship also known as a sole tradership individual entrepreneurship or proprietorship is a type of enterprise owned and run by one person and in which there is no legal distinction between the owner and the business entityA sole trader does not necessarily work alone and may employ other people. Identity card name cant be used as business name. Registration for a sole proprietorship or partnership in Malaysia is only available to Malaysian citizens or permanent residents who are 18 years of age or older as determined by the Malaysian government.

Please do not submit the following for LLPs. Sole proprietorship is an enterprise owned by an individual. It is governed by Companies Commission of Malaysia abbreviated SSM Suruhanjaya Syarikat Malaysia and Registration of Businesses Act 1956.

A photocopy of your Identity Card IC. The first thing you need to do when setting up a sole proprietorship is to go through the registration with the SSM Companies Commission Malaysia. Sole proprietorships are pass-through entities.

Registration of Sdn Bhd. Guidelines f or Business Name Application. You then need to name your sole proprietorship either as your personal name or a business under which you trade.

Furthermore you must complete the Business Name Approval Form if your business name is different. A person who operates a sole proprietorship must bring an action against others in his own name 8. In the case of a partnership you must provide a copy of your partners IC as well.

A sole proprietorship is held entirely by a single person who uses their personal name identity card or trade name. Other taxes paid by a sole proprietorship in Malaysia are. Form B thats for if youre a sole proprietor or Form P thats for a partner in a conventional partnership.

It requires less paperwork and fewer additional legal formalities The cost of incorporation is much lower. 100 investment tax allowance for three years for an existing company in malaysia relocating overseas facilities into malaysia with capital. Business owned by two or more persons but not exceeding 20 persons.

Click here to see all SSM offices in Malaysia. Any person residing in Malaysia by having principal place of residence One. Basically this means you are the business and the business is you.

Partnership is a common business model in Malaysia and requires two partners Malaysian citizens who are at least 18 years old to establish. No7 Jalan Stesen Sentral 5 Kuala Lumpur Sentral 50623 Kuala Lumpur. Being a sole proprietor in Malaysia has its benefits.

Steps to Register a Sole Proprietorship in Malaysia Step 1 Choosing your business name The name you choose can be either your name on your identification card or any name you want.

Quickly Understand The Difference Between Sdn Bhd Llp Sole Proprietorship And Partnership Leh Leo Radio News

Different Types Of The Company In Malaysia Knowing Business Entities Limited Liability Partnership Private Limited Company Sole Proprietorship

6 Types Of Business Entities In Malaysia Tetra Consultants

5 Different Types Of Business Entities In Malaysia

8 Types Of Business Entities To Register In Malaysia Foundingbird

Setting Up A Business In Malaysia Ppt Download

How To Register Ssm Online Beginner S Guide To Sole Proprietorship Youtube

.png)

Mygov Managing Business Starting Business Registering A Business

For Sole Proprietorship Pdf Maybank

Know The Important Details Of Sole Proprietorship In Malaysia

5 Steps On How To Set Up A Company In Malaysia Infographics

Why Sole Proprietorship Or Private Limited Company In Malaysia

6 Differences Between Sole Proprietorship And Sdn Bhd In Malaysia Tetra Consultants

Basic Knowledge Of Sole Proprietorship Business Case Facts By Hhq Law Firm In Kl Malaysia

Quickly Understand The Difference Between Sdn Bhd Llp Sole Proprietorship And Partnership Leh Leo Radio News

Steps To Change Partnership To Sole Proprietorship Company In Malaysia Tetra Consultants

Quickly Understand The Difference Between Sdn Bhd Llp Sole Proprietorship And Partnership Leh Leo Radio News

5 Important Things To Know About Sole Proprietorship In Malaysia Trustmaven

Setting Up A Business In Malaysia Ppt Download